A Hand Up: Microfinance in China

中国小额资金贷款一览

Microfinance is helping people escape poverty across the developing world. Are China’s would-be entrepreneurs getting the same help?

在发展中国家,小额资金贷款项目帮助许多人摆脱贫困。在中国,未来的企业家们得到了这样的贷款帮助么?

by Jonathan Hwang

Date Published: 03/06/2009

Microfinance is helping China's rural population expand their businesses. Photo by Ian Koh, used under Creative Commons License.

Thirteen cows and counting. Yes, Siqinggaowa’s dairy business has really taken off – just buying enough feed to sustain her labor force is now top priority. Back in 1998, she took out a modest loan, only 1,000 RMB (US$150), to start a small dairy company in Inner Mongolia. Now Siqinggaowa wants another 4,000 RMB to bolster production.

“It is beyond my words how much help microfinance has provided me during these 10 years,” says Siqinggaowa on her Wokai profile, a start-up microcredit website now working in China. “It was rare to see a woman in a pastoral area walk out from home and start a business 10 years ago… But to sell the dairy products I made, I overcame my fears and continued to sell them on the street.

Siqinggaowa weighs her work.

From dairy farms to dumpling stands, more and more people are turning to microfinance companies to start or expand their business dreams. And with 40% of its population below the poverty line, Inner Mongolia is a prime target for microcredit operators. Chifeng Zhaowuda Women's Sustainable Development Association (CZWSDA), who assists Wokai in supporting Siqinggaowa, began operating in 1998 with the support of the United Nations Development Program. Of its 3,128 borrowers, 100% are female. Over the past several decades, the practice of lending small amounts to ambitious yet underprivileged entrepreneurs has become a superstar in the global fight against poverty. According to Deutsche Bank, microloans have grown to more than US$25 billion worldwide. The loans, which can range anywhere from US$5 to several hundred dollars, can be enough for new businesses to set up shop. In a country with 200 million people living on less than US$1 a day, China is a clear destination for these micro-banking services.

| Type of Credit Institution in China |

Micro-finance Services? |

Setting |

Oversight |

Method of Capital Accumulation |

Intrest Rates |

Examples |

| National Banks |

No |

Urban/Rural |

State-run & Public Holdings |

Commercial Banking & State Funding |

5-10% |

Bank of China, China Construction Bank |

| Agricultural Bank of China (National) |

Yes |

Rural |

State-run |

Commercial Banking & State Funding |

5-10% |

-- |

| Rural Credit Cooperatives (RCCs) |

Yes |

Rural |

State-run |

Increasing Commercialization, Foreign Donors & State Funding |

12-20% |

Chifeng Zhaowuda Women's Sustainable Development Association |

| NGOs & IOs |

Yes |

Urban/Rural |

Non-profit Orgs & Foreign Govts |

Foreign Contributors, Aid, Gov't Donations |

12-18% |

United Nations Development Program |

| Private Microfinance Companies |

Yes |

Rural |

Private |

Private Foreign Donors |

15-20% |

Wokai |

| Private Lenders "Sharks" |

Yes |

Urban/Rural |

Private |

Private |

20-25% |

Pawn Shops, Wealthy Locals |

We aim to help a range of different social causes in China, whether it be healthcare or education or the environment,” said Casey Wilson, CEO and co-founder of Wokai. “For example, you could buy a solar panel for a family that doesn’t have electricity or you could fund a child’s education for a semester.”

Today, China is home to a wide array of microfinance institutions. The major actors include NGOs and international organizations like the United Nations Development Program, government agencies such as the Agricultural Bank of China, and Rural Credit Cooperatives (RCCs). All operate with different guidelines and goals.

While other countries are more open to accepting international services, nongovernmental organizations within the country currently do not have any legal standing to provide loans, yet often operate with temporary licenses issued by the national government. For NGOs and international organizations like the UN, the required capital is raised through both private sources and governmental funding. Strict restrictions on operations within China, however, often undermine their effectiveness.

State-run banks and agencies are largely driven by policy considerations, leading to microfinance operations that tend to resemble welfare sponsors. In need of profitability, the country’s largest banks, such as the Bank of China and China Construction Bank, have largely withdrawn from rural operations. Currently, the Agricultural Bank of China (ABC) is the only national government institution that has ventured into small-scale financial services. Yet as the banks remain controlled by the state, project sustainability is often disregarded for political considerations, leading to excessive project failures.

RCCs have been a fixture in rural communities since the 1950s. From the1970s to the mid 1990s, the RCCs were under the supervision of the ABC, later coming under the direction of the People’s Bank of China. Since June 2003, however, control of the RCCs has been transferred to provincial governments, leading to their gradual transformation into rural commercial banks. RCCs provide the most financial services to the rural sector with 85% of the country’s agricultural loans. The institutions provide credit lines to rural entrepreneurs, yet remain bogged down under unclear regulatory frameworks and inadequate loan supervision. According to Planet Finance, the RCCs have a non-performing loan ration of 44%.

In a dramatic shift for the government, private lending between citizens was legalized in March 2009. Once-underground lenders, or “loan sharks,” previously operated outside any legal frameworks, yet provide an estimated 2 trillion yuan (US$300 billion) in loans a year. A 2008 survey by Qinghua University claims that about 69% of rural households in eight provinces had borrowed from private lenders, many of which are ineligible to borrow from anywhere else. Private lenders often place extremely high interest rates on their loans – poverty alleviation is not their priority.

“The problem in China is that the demand is not being met, not because it is too huge, but because the market is not open,” said Bai Chengyu, Secretary General of the China Association of Microfinance (CAM). “In the countryside, there are very few financial options…In order to solve this problem, the market will have to be opened and new financial institutions are needed to deliver loans to rural areas. The government is not giving the priority to the poor.”

Wokai, however, has found a new approach to the bogged-down system.

Founded in 2007 by two American students studying at Qinghua University, Wokai operates as an internet-based platform that allows individuals or organizations to access a borrower’s information and provide loans to someone of their choosing. The company altered its operating structure so that loans appear similar to a donation rather than a financial dealing, thus operating largely outside of the state regulatory system. Wokai effectively operates as a platform for lenders to get money to nongovernmental groups already operating within the country. While the system is far from ideal, it fulfills the company’s basic goal – get money to those who need it.

The entire process takes on a philanthropic guise. “Loans” are actually tax-deductible donations that remain within Wokai’s lending system. When a lender in the U.S. supports a farmer in rural China, the money is donated to a field partner who oversees the borrower’s operations. After the loan is repaid, the borrower will be eligible for future loans and the money is cycled back to a second borrower. After a series of three loans, the initial investment is used as long-term loan capital for one of Wokai’s field partners. The company currently has two field partners, one in Inner Mongolia and another in Sichuan, the site of the devastating May 2008 earthquake.

“The main way that we have overcome these hurdles is that we changed our model,” Wilson said. “Originally, you would lend money to support a borrower’s loan and after the borrower repaid, just take your money out of the system. But what we realized is that there was no way of overcoming the restrictions on lending to NGO microfinance institutions.”

Where Wokai focuses only on China, larger microfinance groups like Kiva make it possible for individuals to offer loans directly to small businesses throughout the developing world. These companies have found success in countries like Cambodia and Ghana, providing easy funding for people in countries that lack adequate financial support systems. With stricter governmental controls, however, such a direct system in China is simply not feasible. Kiva China Senior Advisor Qin Ma noted, “The greatest difficulty for Kiva in China is that the government is restricting the flow of capital.” Each loan from abroad requires government approval, which is often difficult to obtain.

In 1994, pilot programs funded by the United Nations began in China, largely modeled after the successes of the Grameen Bank in Bangladesh. Pioneered by Muhammad Yunus, the bank provided no-collateral microloans to the poorest people, primarily women, in Bangladesh to start small businesses. This community of borrowers would create, according to Grameen’s website, “a banking system based on mutual trust, accountability, participation and creativity.” However, the model could not be easily replicated in China.

Bai, who has been in the industry for more than 12 years, sees further governmental reform as pivotal to the continued success of microfinance in China.

“Traditional poverty alleviation programs were not sustainable,” said Bai. “During the project, it is successful. But after the project is done, people are gone, money runs out. But microfinance is a good model that can be sustainable because it takes [a more] commercial approach.”

Bai noted that most institutions start with pilot programs to gauge sustainability. Currently, CAM oversees more than fifty pilot programs. Some of these programs have been successful – the Harbin Commercial Bank’s (now Harbin Bank) microfinance program has seen a repayment rate of 99.4%. Bai noted, however, that most microfinance institutions are faltering because of a lack of supportive government regulations, insufficient funding, and inadequate management.

“In China, we have a lot of money and people want to target the money,” Bai added. “The bridge [between money and borrowers] depends on the government and that is the key in this challenge.” He stated that necessary reforms include establishing regulations and standards in the microfinance industry, greater managerial training, and greater mobilization of commercial funds.

Today, according to a February 2008 Xinhua report , Chinese banks have lent over US$131 billion in microloans to more than 77 million households, nearly 25% of all rural households. Most microfinance programs, charge an interest rate of 12-18% annually to borrowers, higher than most commercial banks in order to maintain sustainability but lower than those from private lenders who often charge 20-25%. RCCs charge between 12% and 20%, while Wokai lies in the middle with 15-20% rates.

The rates are a result of the China Banking Regulatory Commission’s (CBRC) decision to relax interest rate caps from 8% to 28% in 2004. At the time, the CBRC also allowed the first private investment in microfinance institutions in China when Rabobank and the World Bank’s private branch, the International Finance Corporation, acquired a 15% stake in the United Rural Cooperative Bank of Hangzhou. This has been instrumental as microfinance institutions need to charge a higher rate to be sustainable. Following the policy change, Huang Weizhong, Division Chief of the Cooperative Finance Supervision Department at CBRC, stated that “microcredit companies, village banks, and rural mutual cooperatives are the three new types of rural financial institutions that are strongly encouraged.”

Source: Planet Finance, China Country Overview 2008

While interest rate reforms have eased microfinance operations, a primary obstruction continues to be the government’s tight control over money transfers from foreign lenders to domestic microfinance institutions. International organizations have formed to support microfinance institutions seeking to enter new markets, including China. Kira Dubas of Planet Finance, one such consulting organization, believes that the advent of new microfinance models will have a meaningful impact on future practices.

“Two new statuses were set up by [Chinese authorities] in the last three years: microcredit companies and village banks,” Dubas said. “Our work has become a lot more technical, often focused on helping banks downscale to develop a microcredit portfolio with goals of both helping grow financial services inclusiveness and maintaining strong profits.”

Dubas explained that microcredit companies are credit-only enterprises that target rural populations. In order to be sustainable and to expand, these enterprises require foreign capital. However, in China, microcredit companies are not allowed to take deposits, thereby blocking inflow of foreign capital. On the other hand, village banks have full banking privileges including lending and taking deposits, yet they are limited in size and have a complicated ownership structure. In a recent report commissioned by the German Technical Cooperation and the International Fund for Agricultural Development, “The new policy still faces some challenges on promoting competition and attracting more investors and a variety of institutions. From this point of view, the new policy can only play limited role on improving the access to financial services for the poor.”

Although the Chinese government has supported these new institutions, there is still not enough oversight. Organizations like Planet Finance are promoting greater organization among microfinance institutions so that the primary goal of poverty alleviation is met. “Through social performance management, an organization is analyzed at every level, assessing whether or not the organization is attaining its mission,” said Dubas.

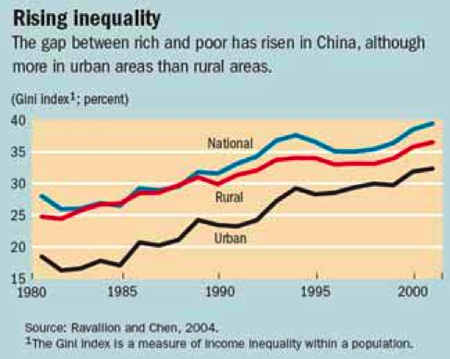

From 1990 to 2005, China halved the number of people living on less than one dollar a day while cutting the percentage of those living under the United Nations’ poverty line from 33% to less than 16%. While the Chinese economy has seen unprecedented growth in recent years, income inequality between the country’s coastal regions and interior provinces is escalating. An urban dweller’s income is now three times greater than that of his rural counterpart.

The recent financial crisis has affected markets worldwide, hitting China’s poor especially hard. Exports have fallen more than two percent since last year, fueling massive layoffs throughout the country. Dubas noted the active role microfinance institutions can play in alleviating any prolonged problems.

“After this Christmas season, there were tens of millions of migrant factory workers that were forced to return to their homes, and will be depending on their families,” said Dubas. “There will be an even more pressing need for microfinance loans, so that families in these rural areas can support their laid-off husbands and sons.”

Microcredit continues to provide an avenue of support for the country’s impoverished, helping decrease inequality while spurring new entrepreneurship. In order for microlending to become truly effective in the country, the Chinese government will need to support microfinance institutions through enhanced regulation and oversight.

Entrepreneurs like Siqinggaowa have seen tremendous benefits from microfinance loans. Through her small business, she has supported her family and her daughter’s college education. She has become a model of success for a revolutionary approach to poverty alleviation and economic development.

Jonathan Hwang is a senior studying International Studies at the University of California, Irvine.

RELATED STORIES

|

For centuries in China, advanced education guaranteed most secure jobs and good incomes. With the slowing economy, growing numbers of college grads are finding it hard to get jobs.

|

|

|

Tourism is booming in Yunnan as marketeers sell the idea of Shangri-la; some worry the cost to local culture and the environment is too high

|

|

|

The state of working conditions has long drawn ire from Western countries, but change is in the works.

|

|

|

"While we appreciate the long hours and the effort that our Chinese counterparts have put into those trade discussions, quite frankly, in the grand scheme of a $300- to $500-billion trade deficit, the things that have been achieved thus far are pretty small. I mean, they're not small if you're a company, maybe, that has seen some relief. But in terms of really getting at some of the fundamental elements behind why this imbalance exists, there's still a lot more work to do."

- Rex Tillerson, US Secretary of State, at a press conference during Pres. Trump's visit to Beijing, Nov. 9, 2017

|